Lifestyle Spending Accounts (LSAs) offer employers a unique opportunity to boost employee engagement and retain talent with flexible benefits. As employer-funded accounts with minimal restrictions, LSAs are fully customizable to support employees’ diverse lifestyle and wellness needs. Designing an effective LSA program requires careful planning and clear goals, and with so many possibilities, it can be daunting for HR teams to know where to start.

In this article, we’ll explore how to design the best LSA for your organization to deliver the maximum impact. We’ll delve into strategies for selecting eligible expenses aligned with your company culture, real client use cases, and implementing effective communication and management plans.

Keep reading to learn how to design a Lifestyle Spending Account program that delivers exceptional value for employers and employees alike.

Here’s what we’ll cover:

- Set clear goals for your LSA program

- How to design a Lifestyle Spending Account program

- Lifestyle Spending Account use cases

- Transform your benefits strategy

Set clear goals for your LSA program

A well-defined set of goals is crucial for the success of any Lifestyle Spending Account program as part of a winning total rewards strategy.

Identify specific objectives that align with your company values. Consider key areas of employee well-being and success like promoting healthy lifestyles, reducing stress and burnout, enhancing work-life balance, boosting productivity, and improving company culture. A purpose-built LSA grounded in measurable goals and defined success metrics delivers maximum value to your employees and your business.

Based on your company’s goals, you can decide whether you want a general-use LSA or a targeted LSA. General-use LSAs offer employees the flexibility to spend the benefits on a wide range of expense categories, such as fitness memberships, wellness activities, or family care costs. This is ideal for companies that want to provide employees with the most choice and flexibility.

Targeted LSA plans to focus on specific areas of well-being, such as mental health, financial wellness, tuition reimbursement, work-from-home or work-from-office allowance, family forming, or physical fitness.

How to design a Lifestyle Spending Account program

Understand employee needs

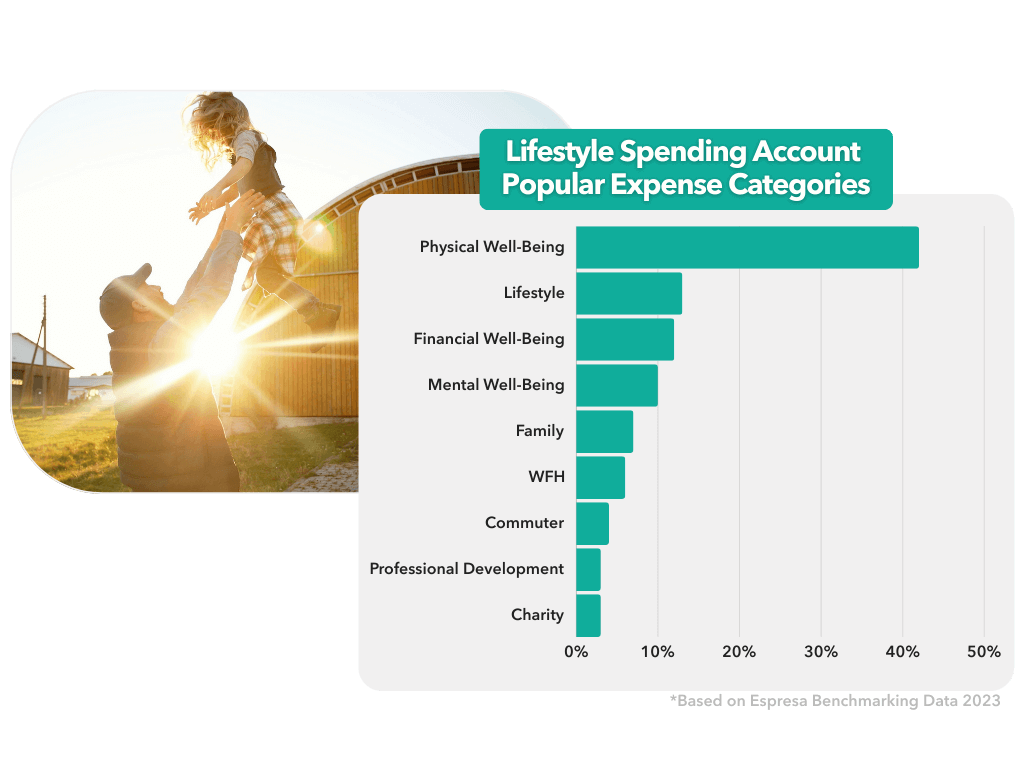

Understanding employee needs is the cornerstone of a successful LSA program. Tailor your program to directly address the needs of your workforce by researching best practices and using surveys and focus groups to identify the most-valued expenses. When direct feedback isn’t available, industry or benchmarking data provided by benefit partners can guide these decisions. A data-driven approach ensures that lifestyle benefits support employees.

Ask employees to share their challenges and wellness goals. For example, a company with a hybrid or remote workforce might identify home office equipment or mental health support as a primary need. If a company’s workforce consists of professionals with young families, prioritize spending categories for childcare, or physical fitness. By understanding employee needs, you can create a benefits package that improves well-being and enhances overall happiness in the workplace.

Promote flexibility with expenses

Maximize the impact of your LSA plan by promoting flexibility and personalization of allowed expenses. A broad range of eligible expenses fosters a sense of autonomy and empowers employees to choose benefits aligned with their preferences. LSAs can adapt to employees’ evolving needs from year to year and are only limited by creativity. Employers choose how these flexible benefits best support employees.

An employee prioritizing emotional well-being and mental health could use their LSA funds for therapy sessions, meditation apps or classes, and stress management programs. Another employee might submit reimbursement claims for financial planning services, debt repayment, and educational resources on budgeting and saving for retirement if financial well-being is their primary concern.

Set clear, simple guidelines

To ensure the success of your LSA program, you must establish and communicate clear guidelines with your employees, including a set benefit amount and eligible expenses. According to Espresa’s client data, most employers offer benefit amounts between $500 and $1,500 annually.

For a global workforce, highlight purchasing power parity to reimburse employees in a way that aligns with the cost of living in different countries, promoting pay equity.

Simplify the submission process with an intuitive intranet portal or mobile app to enhance user experience and maximize participation. Empower informed decision-making by offering examples of eligible expenses and providing helpful resources like spending trackers and vendor directories.

Integrate with existing benefits

Lifestyle Spending Accounts can seamlessly augment existing traditional benefits, enhancing their overall impact. For example, LSAs can complement health insurance plans and Flexible Spending Accounts by covering wellness expenses like gym memberships or mental health services not covered by regulated FSA plans, encouraging a holistic approach to employee well-being.

Additionally, LSAs can address benefit gaps, such as providing financial assistance for dependent care, which are often not covered by traditional benefits. Offering a customizable approach to benefits ensures employees have the support they need to thrive.

Monitor and adjust the program

To measure success, track key performance indicators on a monthly or quarterly basis. Monitor LSA utilization rates, employee satisfaction survey results, and changes in healthcare costs or productivity metrics.

Regularly reviewing and updating plan guidelines ensures the program meets the evolving needs of your workforce. Bonus – Lifestyle benefits are not government-regulated and can flexibly change parameters to adapt to needs at any time in the program’s live or implementation phases. And by aligning the program with strategic business objectives and consistently monitoring its impact, employers can ensure it continues to deliver maximum value.

Encourage engagement

Maximize Lifestyle Spending Account participation by implementing a comprehensive communication strategy that highlights the program’s benefits. Share success stories from employees who have utilized their funds to inspire others to take advantage of the program. Offer incentives like earned allowances, available in Espresa LSA Plus™, to increase engagement in well-being and culture initiatives, onboarding or learning and development, or to reinforce healthy behaviors like social engagement or community outreach.

Provide easily accessible resources like FAQs to empower informed spending decisions. Consistent promotion and valuable information foster a culture of well-being and encourage full benefit utilization.

Leverage technology

You can also enhance your LSA plan by leveraging technology. A flexible benefits platform empowers employees to choose where and how they spend their funds, and even how they pay. By providing employees access to an integrated marketplace, employers can maximize employee engagement regardless of global location.

Implementing and managing the program with a user-friendly platform simplifies administration and provides employees with a seamless experience. With mobile or desktop access, employees can manage their benefits and track spending from anywhere in the world, granting them real-time access to their account balances and transactions. This empowers them to make informed decisions and track their spending effectively.

Lifestyle Spending Account use cases

Lifestyle Spending Accounts offer a versatile platform for employees to address a variety of needs. Here are some common use cases based on real Espresa clients:

Promote work-life balance

Employees seeking to optimize their daily routine decide to allocate their funds towards a meal planning and delivery service to streamline meal preparation, reducing stress and saving time. Additionally, they utilize a portion of the funds for public transportation passes, decreasing commuter anxiety and increasing productivity. Employees invest in sports league memberships to enhance work-life balance, prioritizing physical health, social connection, and mental well-being.

Support growing families

The arrival of a new child brings significant life changes. Employees can leverage their funds for services that support parents and children. For instance, investing in postpartum meal delivery, doula services for guidance and support, and a night nanny to assist with newborn care can ease the transition to parenthood. These benefits contribute to employees’ overall well-being and job satisfaction, allowing them to return to work feeling refreshed and prepared.

Targeted support

Lifestyle Spending Accounts can be expanded to include targeted support for a specific category of identified needs. For example, an organization might determine that learning and development is a top priority and allocate additional separate funds specifically for tuition reimbursement.

For more creative ideas and LSA use cases, watch our webinar on Getting Creative With LSA Programs.

Transform your benefits strategy

As companies strive to meet employee expectations for personalized lifestyle benefits and wellness programs, a well-designed lifestyle benefits program enhances employee happiness, productivity, and loyalty. Espresa’s LSA platform helps companies design Lifestyle Spending Accounts that boost engagement and set up HR teams for success.

Espresa can help you create a customized solution that aligns with your business goals. Contact us for a free demo today!

How to Promote Health Equity in the Workplace: A Guide For Employers