The talent landscape has shifted dramatically in recent years, and leaders who proactively build a winning total rewards strategy give their organizations a competitive advantage. While workers aren’t switching jobs at the breakneck pace they maintained through 2022, talent is still looking for fulfilling work, flexibility, and a fantastic company culture.

Companies face fierce competition for skilled employees. The U.S. Chamber of Commerce reports only 71 workers for every 100 jobs. According to a poll from Employ Inc., 81% of recruitment professionals say filling roles is a challenge. As businesses adjust and right-size for their needs, they ask more of their existing workforces. A robust total rewards strategy is necessary to stay competitive in today’s work environment.

In this article, we’ll explore how organizations can build a winning total rewards strategy that attracts, engages, and retains top talent. We’ll also explore the key elements of total rewards and how Lifestyle Spending Accounts (LSAs) can be a valuable tool to level up your program, offering employees more flexibility and control.

Here’s what we’ll cover:

- What is a total rewards strategy?

- What are the key elements of total rewards?

- 7 tips for developing a total rewards strategy

- LSAs: the glue of a robust total rewards strategy

What is a total rewards strategy?

A winning total rewards strategy offers a holistic approach to employee compensation and benefits. Comprehensive rewards go beyond basic benefits to encompass professional development opportunities, a culture of employee recognition, and well-being initiatives. By addressing key needs – financial security, well-being, recognition, and growth – strong total rewards programs increase employee engagement, cultivate loyalty, and improve mental health outcomes.

LSAs are the ultimate flex perk to supercharge your total rewards strategy. Designed to adapt to the changing needs of employees and organizations, they allow for quick adjustments and launches of new benefit offerings to reflect the evolving needs of your workforce. They can be an extra benefit layer that adapts to employees’ unique needs and goals.

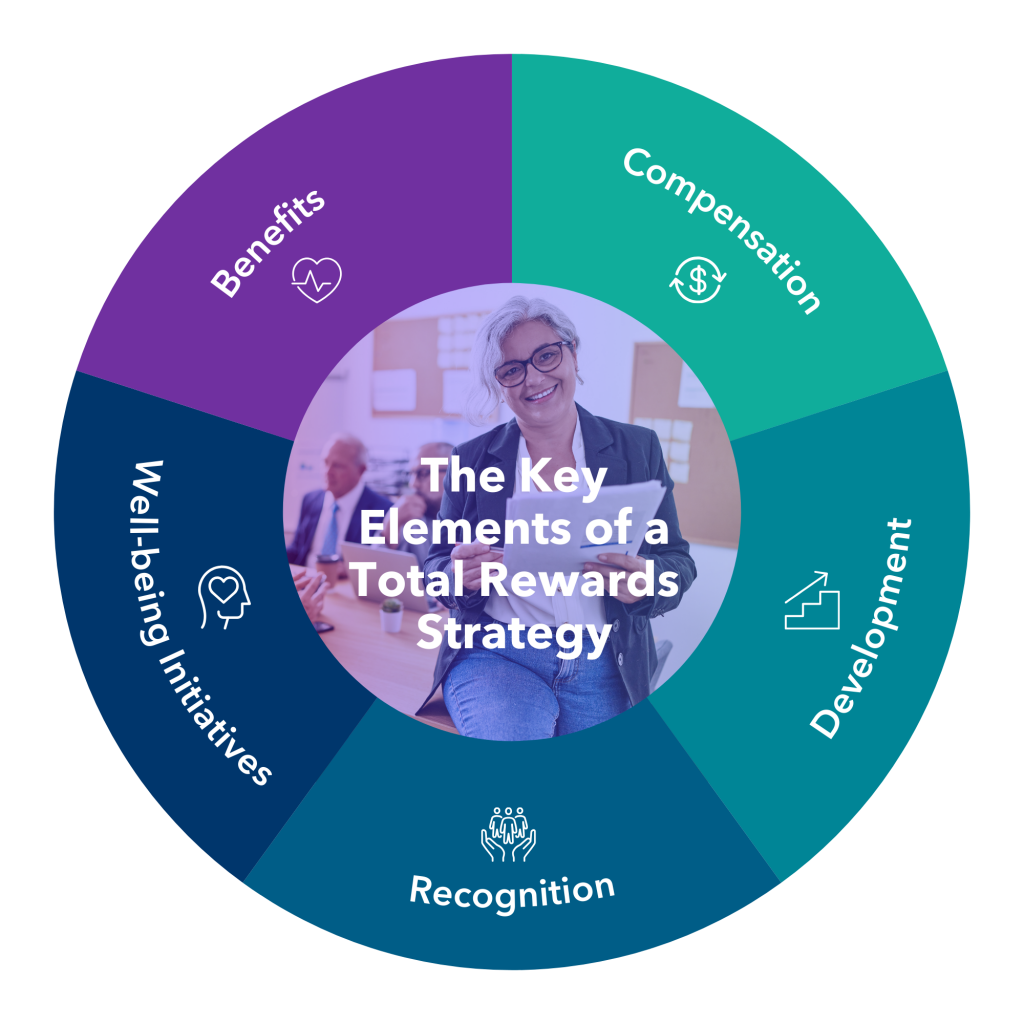

What are the key elements of total rewards?

The key elements of a total rewards strategy are compensation, inclusive benefits, well-being programs, recognition, and development. Each element is critical and works together to create a powerful formula for attracting top talent, retaining employees, and motivating your workforce.

Compensation

Top talent expects more than a base salary. You can level up your compensation game with bonuses for exceptional performance, commissions for top salespeople, flexible and adjustable reimbursements and wallets, and long-term incentive and profit-sharing programs to celebrate individual company success.

Benefits

Beyond financial compensation, benefits are the superhero of your total rewards strategy. They include health insurance for peace of mind, dental and vision plans for healthy smiles, paid time off to recharge, and retirement savings plans to fuel future dreams. Traditional benefits show you care about your employees’ well-being, not just their work. Unexpected and personalized benefits enhance and set your rewards strategy apart.

Well-being initiatives

Elevated modern well-being initiatives take a holistic approach to total well-being that keeps their workforce happy, healthy, and thriving. Beyond basic perks, these initiatives utilize choice and challenges to inspire healthy habits and fuel healthy bodies and minds. And they support mental health across different stages of employees’ lives.

Watch // Webinar: Well-Being Reimagined

Recognition

The power of appreciation is unleashed with a comprehensive recognition strategy. Team members feel empowered to celebrate each other’s wins, team leaders are equipped with inclusive recognition reward tools, and company-wide acknowledgments celebrate outstanding achievements. Recognizing teamwork and collaboration fosters a truly connected team environment. Incentivized recognition programs that enable employees to redeem rewards in personal ways offer HR the opportunity to reach people in ways that are meaningful to them.

Development

A growth mindset supercharges your development strategy with a dynamic blend of training, ongoing learning opportunities, tuition reimbursement, and mentorship. Equipping employees with the skills, knowledge, and support to thrive keeps your teams engaged and future-proof. Making development goals personal creates greater relevance and connection to an organization’s vision, mission, and goals.

7 tips for developing a total rewards strategy

Today’s workforce, particularly younger generations, values balance and purpose-driven work. Future-focused organizations evolve their rewards program to reflect each generation’s needs and expectations. Here are 7 key tips for developing a successful strategy:

1. Understand your people

Building a comprehensive total rewards strategy starts with understanding your people. Surveys, diverse focus groups, and one-on-one meetings provide opportunities to listen when employees share their needs and priorities. Data on current usage and underutilized benefits help benefits teams pinpoint areas where additional offerings could shine.

Each generation has distinct needs. Embrace customization by offering flexible benefits packages that promote health equity and ensure employees feel valued and supported in all stages of life to achieve their goals.

2. Benchmark your competition

Knowing the competition keeps an organization ahead of the curve in today’s dynamic talent market. Companies like Airbnb, Avalara, JM Family, Nielsen, Pinterest, and Procore offer inclusive and customized benefits that recognize the power of people-first strategic offerings.

Find out what’s creating a buzz in your industry. Maybe it’s flexible work arrangements, unbeatable wellness programs, or generous and personalized reimbursement programs. Use this knowledge to inspire innovative ways to elevate your employee experience and supercharge your superstars.

3. Level up

Future-focused leaders level up their rewards strategy with perks that go the extra mile and truly attract and retain top talent. While competitive salaries are mission-critical, prospective employees want flexible work schedules and an organization that promotes work-life wellness. Balance isn’t a passing trend. It’s the new standard. Embrace flexibility by offering remote or hybrid work, compressed workweeks, flexible start and end times, or job-sharing.

Beyond-the-expected benefits like childcare subsidies, student loan repayment programs, pet insurance or pet-friendly workplace policies, generous family leave policies, and sabbaticals to celebrate work anniversaries set your rewards strategy apart and surprise and delight your people.

4. Focus on choice

Cookie-cutter benefits packages are out. Today’s top talent craves choice and personalization. Language learning apps for travel enthusiasts, pet care services for animal lovers, community involvement at work and home for remote workers who spend all day staring at screens, gym memberships with childcare options, and family-friendly benefits for busy parents.

LSAs offer the ultimate choice and customization, allowing organizations to effectively address diverse employee needs and preferences to fuel stability, purpose, and success.

5. Invest in employee well-being

Employee well-being is a strategic imperative. A happy, healthy workforce is a powerhouse of productivity, creativity, and engagement. Investing in employee well-being is the future of total rewards.

Craft a holistic strategy to promote mental health and well-being at work and help employees manage their personal and professional lives so they can thrive inside and outside the office. Meal delivery partnerships feed healthy bodies, mindfulness, and movement help manage stress, and financial counseling provides long-term stability.

6. Foster a culture of recognition

Employees crave appreciation, especially when they go above and beyond at work. Public recognition spotlights exceptional efforts, validating contributions and boosting confidence. A culture of gratitude encourages employees to recognize and socialize achievements across teams.

A holistic rewards and recognition program where everyone can have a voice of praise drives engagement for more meaningful, personalized experiences. Multiple channels for praise, such as peer-to-peer recognition, social media shout-outs, and customized rewards, create a symphony of appreciation.

7. Align with your mission, vision, and values

Comprehensive benefits showcase an organization’s unique culture and values. Align rewards offerings with your company’s core values. Your strategic benefits are part of your company’s DNA. Embodying your brand attracts top talent who share your mission and vision.

Companies where innovation drives success will supercharge employee learning and development with educational reimbursement for disruption-driven courses and conferences. When collaboration and growth characterize a culture, leaders invest in mentorship and returnship programs. They connect experience and fresh talent to foster a culture of continuous learning. And when social responsibility is a core value, paid volunteer days allow employees to support meaningful causes.

LSAs: the glue of a robust total rewards strategy

A robust total rewards strategy is a competitive advantage. Strategically deploying an LSA can elevate your comprehensive benefits program to fuel employee engagement and business success. Fuel well-being initiatives with wellness challenges, incentivize culture-aligning behaviors through recognition programs, and support learning and growth with flexible and adjustable funding. When you elevate your benefits program, everyone wins.

Boost employee engagement and Value on Investment (VOI), whether your goal is to attract and retain top talent, enhance employee experience, or optimize administration for your HR department. Create a strong, inclusive workplace culture positioned for sustained success with an LSA from Espresa. Contact our team to learn more and schedule a demo!

Ease the Effects of Inflation on Employees with a Lifestyle Spending Account